Here at The Mortgage Professionals, we have access to over 30 lenders, including some of top banks.

We offer you the best mortgage based on your financial needs, looking for a low rate, competitive terms and a lower potential future penalty to exit the mortgage. The non-bank lenders we use are also known as monoline lenders. Monoline lenders specialize in mortgages and often offer better rates and products than the Banks. One key benefit to dealing with a monoline lender is that their penalties are often thousands of dollars less than a Bank lender.

What is a Mortgage Penalty?

Banks refer to penalties as “Prepayment Charges.” Don’t get confused –the charge is a penalty to pay out your mortgage before the end of the term. The average Canadian keeps their mortgage for 3.8 years, due to relationship breakdown, refinancing, moving to another house, downsizing, death, etc.

Almost all lenders calculate penalties on fixed rate mortgages by taking the higher of two calculations: Interest Rate Differential (IRD) or 3-months of interest. Where non-bank lenders differ is in the calculation of their IRD.

Bank lenders use “posted rates” and convince you that they are giving you a discount at the beginning of your term. For example, a bank’s recent posted 5yr rate is 5.19% but it’s actual 5yr mortgage rate was 3.34%.

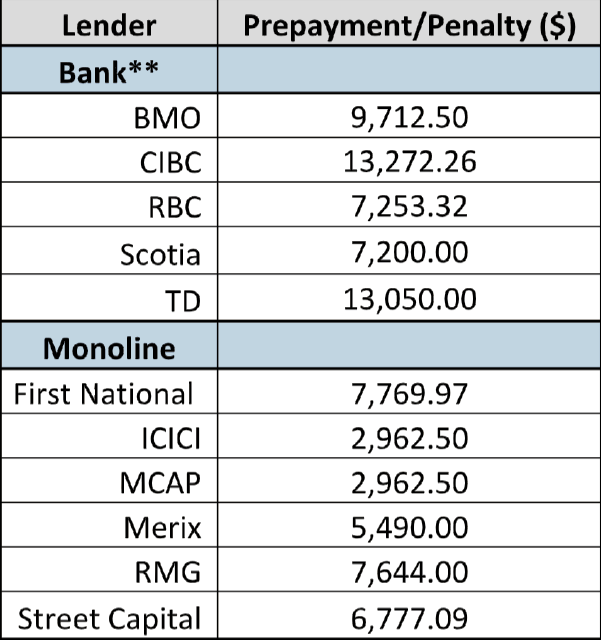

Using a posted rate allows Banks to charge a much higher penalty. Monoline lenders will use the mortgage / contract rate (much lower than the posted rate) to calculate the IRD, resulting in a much lower penalty. To further understand the difference between borrowing from a bank and a monoline lender, we have done some example penalty calculations for you, comparing the penalties across lenders for the same terms:

Summary

The majority of these numbers can be found using the lender’s prepayment calculators on their website.

**In order to get accurate results if you have a bank mortgage, you will need to know the exact discount rate you received from the posted rate, which can only be found on the documentation from when you first entered the mortgage. The discount rate used to calculate the values in the bank table below was 1.39%, had you estimated a value of 1.30% than the penalty for BMO would have been $1,000 from the actual value.