Most banks now default to providing you with a collateral mortgage (versus a conventional mortgage provided by most non-bank lenders).

But what does that mean to you?

What is a collateral mortgage?

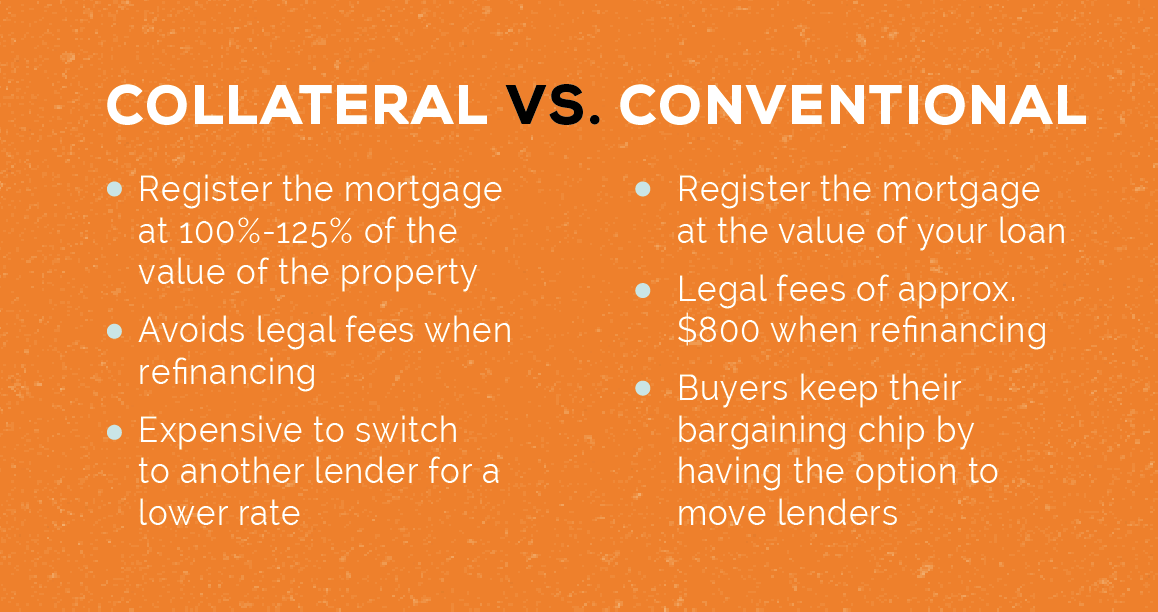

- With a collateral mortgage, banks can register the mortgage up to 125% of the current value of your property (a conventional mortgage registers the mortgage at exactly the amount borrowed).

- The benefit to a collateral mortgage is that you can access additional equity in your property in the future at a reduced cost. To access that equity you will need to refinance, which has some costs:

- Both a collateral and conventional mortgage require you to pay for an appraisal (approx. $350) when refinancing

- However, when refinancing a collateral mortgage, legal fees are covered by the lender. This can save you upwards of $800

- One downside of a collateral mortgage is the increased cost to switch your mortgage to a different lender for a better rate. It’s great that you save $800 in legal fees during refinancing, but you lose the power to negotiate with the lender to get a lower rate at maturity; which in the long run, could cost you thousands

- For example, on a recent $250,000 mortgage we saved a client 0.15% versus their bank. That’s a savings of over $1,800 in interest.

- Banks are smarter than ever and will do anything to keep you as a client. If you over-extend your mortgage up to 125% it will be much more challenging to leave

SUMMARY:

What’s right for you?

The answer might not be straight forward, which is why we are here to help you find the best option for you. Call a mortgage professional today, and let us guide you in making the best decision for your financial future. #WeAreProfessionals